Divine Info About How To Fight Bank Overdraft Fees

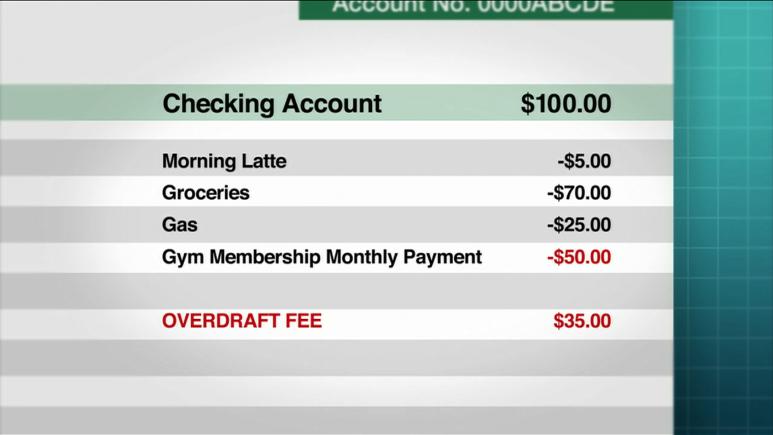

Overdraft fees may occur when a payment is authorized and there's not enough funds in your bank account to fully cover the transaction.

How to fight bank overdraft fees. Open the donotpay fight bank fees product. We will charge you a fee of $15.00 each time we pay an overdraft, unless one of the following exceptions applies: Once you are on the phone with a customer service representative from your bank, kindly inform them that you incurred an accidental overdraft fee and would like to have the fee.

Choose which fees you want to waive, including overdraft, atm,. The amount of the transaction is less than $5.00 the overdraft results. Call your bank, and ask for the removal of the overdraft.

Have donotpay request pnc bank to refund your overdraft fees this is the easiest and least frustrating way to handle your request for a pnc overdraft fee refund. Choose which fees you want to waive, including overdraft, atm, and. Start by calling up your bank and politely asking to have the fee waived.

Open the donotpay fight bank fees product. The #1 way to get an overdraft fee refunded is to contact your bank and ask. As part of their customer service policies, many banks will refund at least one overdraft fee every.

That way funds can be transferred, as needed,. Verify the last 4 digits of your bank account. Enter the name of your bank.

Human interaction is the most important part of trying to get overdraft fees refunded. If you want to get first bank overdraft fees waived fast but don't know where to start, donotpay has you covered in 4 easy steps: The donotpay fight bank fees product helps you waive and petition for excess overdraft fees in just a few easy steps: